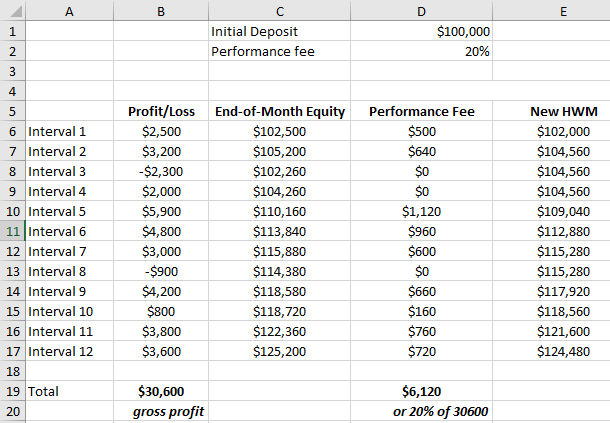

Here is a simulation on 12 intervals of time:

Interval 1: The trader makes a profit of $2,500. The performance fee is 20%, so $500 goes to the trader (20% of $2,500) and $2,000 goes to the investor. So the investor’s equity after the first interval is now $102,000. It is the new high water mark or net equity benchmark below which no new performance fee can be charged.

Interval 2: The trader makes a profit of $3,200. The performance fee is 20%, so $640 goes to the trader (20% of $3,200) and USD 2,560 goes to the investor. So the investor’s equity after the second interval is $104,560. It is the new high water mark.

Interval 3: The trader loses $2,300 and no performance fee is charged. So the investor’s equity after the third interval is $102,260 and the high water mark remains $104,560 (gap to fill: $2,300).

Interval 4: The trader makes a profit of $2,000, which is not enough to reach the high water mark ($104,560). The investor’s equity after the fourth interval is $104,260. Even if the gap to fill is reduced to $300, no performance fee is charged.

Interval 5: The trader makes a profit of $5,900. The first 300$ fill the gap to reach the high water mark and the remaining 5,600$ is a new performance. The performance fee is 20%, so $1,120 goes to the trader (20% of $5,600). The investor’s equity after the fifth interval is $109,040 (104,260+5,900-1,120). It is the new high water mark or net equity benchmark below which no new performance fee can be charged.

… etc